| Deposit | Free |

| Fees | Taker: 0.10% – 0.25%, Maker: 0.0% – 0.25% |

| Fiat Deposit | USD |

| Withdrawal | Free |

| Accepted Payment Methods | Wire Transfer, ACH, BTC, ETH |

| Margin Trading | No |

| Market With Fees | Yes |

In 2025, cryptocurrency trading continues to gain momentum, and Gemini stands out as a trusted platform for secure and efficient trading. Known for its regulatory compliance, robust features, and beginner-friendly interface, the exchange caters to both novice traders and experienced investors. Whether you’re exploring Bitcoin, Ethereum, or emerging altcoins, it offers tools to help you navigate the dynamic crypto market with confidence. This guide provides a comprehensive overview of strategies, features, and tips for maximizing your trading potential on this exchange, making it your go-to resource for smart crypto trading this year.

Gemini exchange is a premier cryptocurrency exchange that emphasizes security, transparency, and accessibility. Founded in 2014 by Cameron and Tyler Winklevoss, it caters to both beginner and professional traders with a wide range of services. With operations in over 60 countries, the platform combines advanced trading tools with an intuitive user interface, making it an ideal choice for individuals and institutions alike. Whether you’re investing in Bitcoin (BTC) or exploring DeFi tokens, this trading platform provides a secure and user-centric environment to grow your portfolio.

It offers a range of trading methods suitable for both beginners and experienced crypto traders. Users can buy, sell, and trade over 120 cryptocurrencies through an intuitive platform. The exchange supports various features, such as spot trading, limit orders, and advanced trading options. Gemini also provides the ActiveTrader interface for more experienced users, allowing for reduced fees and advanced charting tools. In addition, it prioritizes security with features like two-factor authentication (2FA) and cold storage for most of its assets, ensuring a secure trading environment.

It has distinguished itself as a premier cryptocurrency exchange by focusing on security, transparency, and a user-centric design. Let’s examine the key reasons it’s a top choice for traders:

From account setup to withdrawals, it ensures a seamless trading journey. Here’s how to navigate the process:

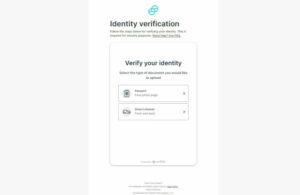

Verification is essential for accessing the full range of features of this platform. Start by creating an account on Gemini exchange using a valid email and secure password. After logging in, complete the identity verification process by providing a government-issued ID (e.g., passport or driver’s license) and proof of address, such as a utility bill. Institutional accounts may require additional documentation, like a certificate of incorporation or business tax filings. On average, it processes individual verifications within 24 hours, but complex cases, especially institutional accounts, may take up to 72 hours.

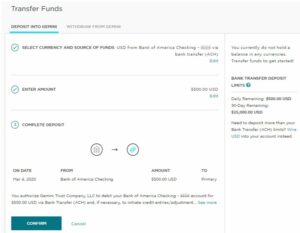

Depositing funds into your Gemini account is a seamless process, whether you’re dealing with cryptocurrency or fiat currency.

Cryptocurrency Deposits

Fiat Deposits

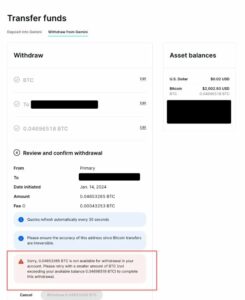

It makes withdrawals equally efficient for both cryptocurrencies and fiat currencies.

For Cryptocurrencies

For Fiat Currencies

By following these steps, traders can seamlessly navigate the exchange’s deposit and withdrawal processes, ensuring both speed and security.

Trading on Gemini exchange involves leveraging its advanced tools and adhering to its security protocols to maximize efficiency and safety. Understanding the platform’s nuances ensures a smooth and profitable trading experience.

It offers a robust suite of tools tailored to cater to diverse trader needs:

ActiveTrader Interface

This advanced trading dashboard is ideal for professionals. It provides real-time charting tools, multiple order types (e.g., limit and stop-limit), and lightning-fast execution. The interface caters to high-frequency traders and ensures minimal latency.

Gemini Earn

With Gemini Earn, users can lend their cryptocurrencies and earn annual yields of up to 7.4%. This feature supports several popular coins like Bitcoin, Ethereum, and stablecoins such as GUSD, allowing traders to maximize idle assets.

Price Alerts and API Access

It allows traders to set customizable price alerts and provides API access for algorithmic trading. These features empower users to automate and optimize their trading strategies.

Educational Resources

Gemini Cryptopedia offers in-depth guides and tutorials, covering topics from blockchain basics to advanced trading techniques. This resource is invaluable for traders looking to enhance their market knowledge.

Security is Gemini’s hallmark, making it a preferred choice for cautious investors:

Cold Storage and Insurance

Over 95% of user assets are stored in geographically distributed cold wallets, ensuring minimal exposure to online threats. Furthermore, Gemini’s insurance coverage protects against losses due to breaches or fraud.

Two-factor Authentication (2FA)

It requires 2FA for all transactions and account access, ensuring that even if passwords are compromised, accounts remain secure.

Withdrawal Whitelists

Users can set withdrawal whitelists, ensuring funds can only be sent to pre-approved addresses. This reduces the risk of unauthorized transactions.

Regulatory Compliance

It complies with strict financial regulations, including New York’s BitLicense requirements and global AML/KYC standards. Its adherence ensures user trust and legal clarity.

Trading on this platform involves strategic planning to maximize your experience and returns. Below are critical aspects to keep in mind:

Transaction Fees

Gemini’s fee structure varies depending on your trading interface and volume. The standard interface charges up to 1.49% per transaction for casual users. However, opting for the ActiveTrader platform significantly reduces fees, with makers paying as little as 0.03% and takers paying 0.10%. For instance, if you trade $10,000, ActiveTrader fees could save you over $140 compared to the standard interface.

Network Congestion

Cryptocurrency transactions rely on blockchain networks, which can become congested during high trading activity. For example, Bitcoin and Ethereum transactions can take over an hour to confirm during market peaks. Diversifying your trading times and enabling priority processing options can mitigate these delays.

Diversification Opportunities

It supports over 120 cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), and emerging altcoins like Polkadot (DOT) and Solana (SOL). To manage risk, consider diversifying investments across stablecoins (e.g., USDC), high-cap cryptocurrencies, and altcoins. For instance, a portfolio with 40% Bitcoin, 30% Ethereum, 20% stablecoins, and 10% altcoins provides exposure to different risk levels.

Stay Updated on Regulations

As a regulated exchange operating in multiple jurisdictions, it ensures compliance with laws such as New York’s BitLicense and the European Union’s AMLD5. Traders should stay informed about local regulations, especially if they operate across borders. For example, in 2024, this platform introduced mandatory tax reporting features in the U.S., ensuring users comply with IRS requirements.

By considering these factors, traders can effectively navigate Gemini’s platform, minimize risks, and optimize their investment strategies.